TYPE-IN CAPTCHA Could Prevent Orders and Affect Customer Registration and Product Reviews

TYPE-IN is a 3rd-party CAPTCHA (prove you are not a robot) by Solvemedia that is no longer in service. If activated in a store, instead of displaying an image or phrase for a shopper to select, it will error out and prevent the shopper from checking out. In addition, if used in Customer Registration, new customers will not be able to register and if used in Product Reviews, shoppers will not be able to leave a review. Merchants should select another CAPTCHA service such as reCAPTCHA by Google or disable CAPTCHA.

CAPTCHA Settings

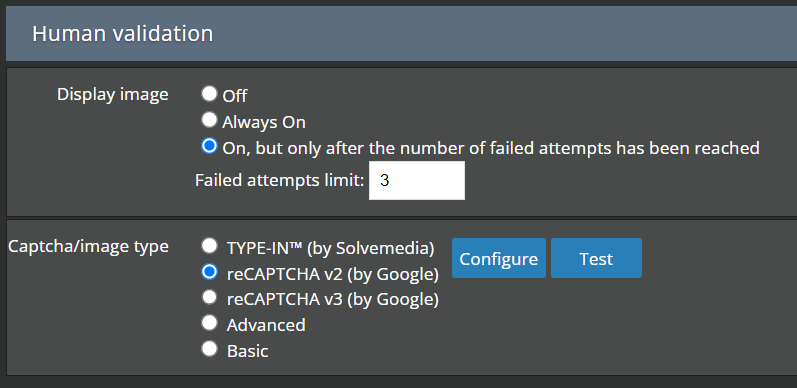

In ShopSite 14 CAPTCHA is configure under Commerce > Payment > Human Validation.

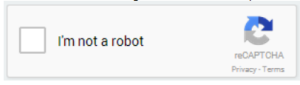

Our recommendation is to have CAPTCHA on after some number of failed attempts and to use one of the Google reCAPTCHA services. For example, if reCAPTCHA v2 is on the shopper will need to check a box similar to the following.

Behind the scenes, Google does some calculations to determine if it was a robot that checked the box. This feature helps reduce the number of fake/fraud order attempts.

For more information on setting up reCAPTCHA see the ShopSite help docs. Note that if you have CAPTCHA enabled for ShopSite Pro’s Product Reviews or Customer Registration features, Advanced and Basic CAPTCHA will not be available as an option.